- 18th November, 2025

- By Rob Wallace

Simplifying Business with Digital ID: A Guide to Getting Started

With services and customers becoming more digital, managing customer identities securely and efficiently has become a top priority for organisations. Traditional identity verification methods, such as collecting and storing physical documents, are not only tedious and resource-intensive but also expose businesses to significant security and compliance risks.

These outdated processes can lead to data breaches, operational inefficiencies, and a poor customer experience. So how do we address these challenges?

Digital ID solutions have emerged as a smarter, safer, and more streamlined alternative. By enabling businesses to verify identities electronically, Digital ID technology is changing how we see security across industries.

By understanding these variations in identity verification, businesses can achieve a balance between security, user experience, and compliance.

The Problem with Traditional Identity Verification

The old way of verifying identities often involves manual data collection methods. Scanning documents, copying IDs, and keeping personal information in filing cabinets are labour-intensive and error-prone. Moreover, these methods carry significant security risks - lost paperwork, hacked digital records.

For any business, such vulnerabilities can lead to reputational damage and regulatory penalties. Plus, they also need to comply with data privacy regulations such as the Australian Privacy Act 1988 and the Consumer Data Right (CDR) framework. So relying on outdated verification practices can expose organisations to non-compliance risks and costly penalties.

Manual processes also slow down customer onboarding, frustrate users with repetitive form-filling, and create inefficiencies in record management. A recent PwC survey found that nearly 70% of Australian businesses cite “manual verification bottlenecks” as a leading obstacle to their business operations.

Additionally, companies are susceptible to human error, such as misfiled paperwork and incorrect data entry. These challenges are an important reminder of the urgent need for a secure, automated, and standardised approach to identity verification - one that reduces risk and improves trust.

Understanding Digital ID

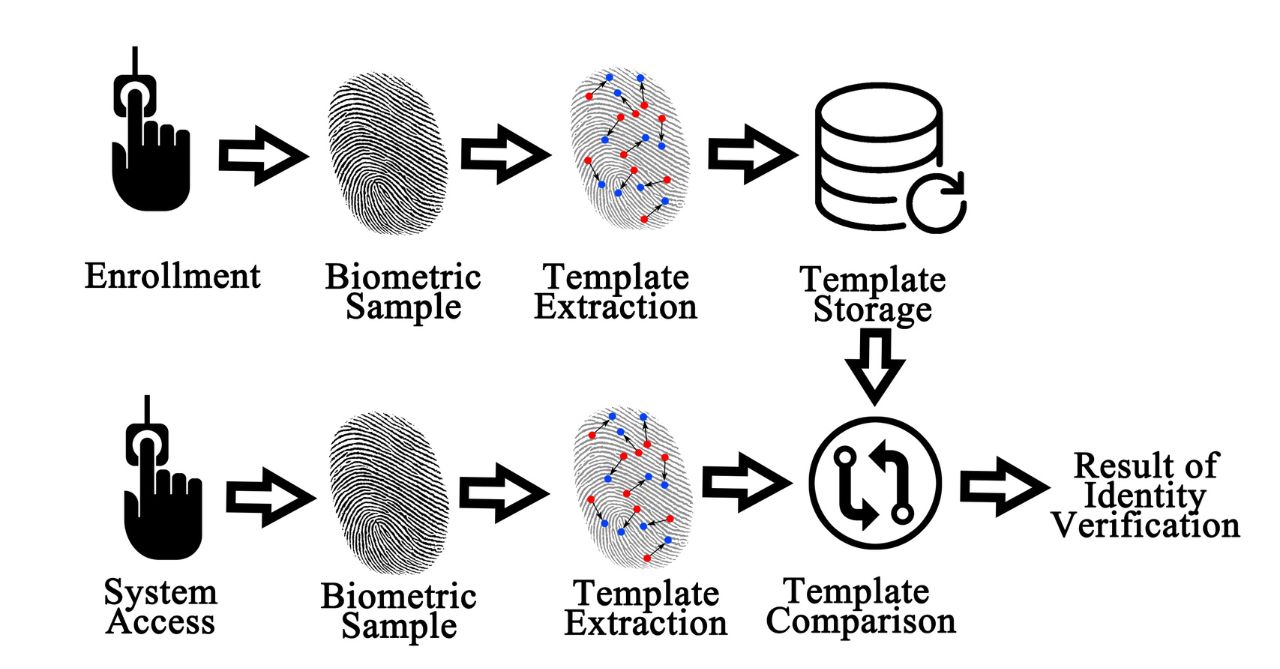

Digital ID simplifies the process of identity verification. Using a simple app, it allows businesses to verify a customer's identity electronically without handling physical documents. Customers upload their data into the app, which is managed by a trusted, accredited provider, and can use this data across multiple industries and businesses that require identity verification.

Digital ID is provided by accredited providers who are compliant with the Australian Digital ID Act and meet strict standards for privacy and security.

By adopting Digital IDs, businesses can:

- Avoid the need for physical document storage.

- Minimise the risk of data breaches.

- Improve the efficiency of customer onboarding.

- Enhance customer trust and satisfaction.

Beyond convenience, Digital ID represents a major step forward in how Australia manages online identity assurance. Instead of scanning and emailing sensitive documents, individuals can securely prove their identity using encrypted credentials. Each interaction is protected by multi-factor authentication, encryption, and user consent, ensuring that personal data is only shared when necessary.

The Australian Government’s 2024 Digital ID Bill supports this initiative by providing a national standard for identity verification, enabling both government agencies and private businesses to use verified identities safely across platforms. This makes digital IDs not only a security upgrade but also a compliance advantage for organisations operating in sectors like finance, telecommunications, education, and healthcare, where accurate identity checks are crucial.

According to a Deloitte Access Economics report, widespread adoption of Digital ID in Australia could deliver over $3.3 billion in annual economic benefits by streamlining verification, reducing fraud, and enhancing customer trust.

Steps to Implementing Digital ID

1. Identify Your Needs

Start by defining the specific identity information your business requires. Simplify it to only what truly matters. Collecting only essential data not only streamlines the verification process but also aligns with the Australian Privacy Principles (APPs), which emphasise minimal data collection.

Consider touchpoints such as customer onboarding, vendor verification, and employee authentication to identify where digital identity verification can add the most value.

2. Select a Trusted Provider

Partner with a Digital ID provider accredited under the Australian Digital ID Act and the Trusted Digital Identity Framework (TDIF). These providers adhere to stringent national standards for security, encryption, and consent management. Working with a certified provider ensures compliance with privacy legislation and demonstrates your organisation’s commitment to data protection and digital trust.

For example, leading Australian-accredited providers enable biometric verification, encrypted data exchange, and consent-driven access, ensuring that sensitive information remains secure at all times.

3. Integrate Seamlessly

Work with your provider to integrate Digital ID technology into your current systems and platforms. This process should be smooth, and should not disrupt ongoing operations. Many providers offer API-based integration, enabling your CRM, HR, or customer management systems to communicate directly with the Digital ID platform in real-time.

A well-planned integration minimises downtime, improves workflow efficiency, and improves the customer experience by enabling instant verification and onboarding.

4. Train Your Team

Educate your employees on how to handle Digital ID processes. This empowers them to use this technology effectively and securely. Regular training ensures your staff understand privacy obligations, recognise potential red flags, and maintain compliance.

Consider implementing an internal Digital Identity Policy and conducting periodic audits to further reinforce accountability and strengthen data governance practices.

The Benefits of Moving to Digital ID

Switching to digital IDs not only protects a business from the traditional pitfalls of identity verification but offers forward-looking benefits:

1. Boost Efficiency:

Speeds up the onboarding process for both customers and employees. With Digital ID, verification that once took hours or even days can now be completed in seconds. This efficiency reduces friction across customer journeys and internal HR processes.

According to Deloitte Access Economics, organisations adopting Digital ID report a 60% reduction in average onboarding time, leading to faster conversions and improved user satisfaction.

2. Foster Innovation:

Frees up resources previously used for manual tasks, allowing room for growth and innovation. By automating identity verification, businesses can reallocate staff and budgets toward strategic priorities such as product development, customer engagement, or cybersecurity improvements.

3. Compliance Assurance:

Decreases data errors associated with manual entry, improving the overall accuracy and trustworthiness of records. Digital ID platforms use automated validation, biometric checks, and real-time database cross-referencing, which significantly reduce human errors. This accuracy not only enhances internal record-keeping but also strengthens the reliability of customer insights, a critical asset for data-driven decision-making and fraud prevention.

4. Data Accuracy:

Digital ID providers ensure you meet regulatory requirements, simplifying compliance management. This proactive compliance reduces the risk of legal exposure and financial penalties associated with data mishandling or breaches.

Real-World Example: RatifyID

RatifyID is a Melbourne-based digital ID provider that offers streamlined identity verification services. Targeting industries plagued by account fraud and identity risks, such as telecommunications and banking, their approach ensures data security without cumbersome document management.

What sets RatifyID apart is its full accreditation under the Australian Government’s Trusted Digital Identity Framework (TDIF) in data privacy, security, and usability. This accreditation confirms that RatifyID meets the nation’s highest standards for identity assurance and operates with complete transparency and user consent.

Conclusion

Digital ID has become critical to trust, security, and compliance in an increasingly digital economy. As organisations modernise their operations, the ability to verify and authenticate users seamlessly while safeguarding their privacy is now a key competitive advantage.

That’s where RatifyID steps in. As Australia’s only reusable, government-accredited Digital ID provider, RatifyID enables businesses to verify identities quickly, securely, and compliantly across industries such as finance, telecommunications, and government services. Its trusted, TDIF-certified platform eliminates manual document handling and delivers a frictionless user experience.

Don’t let outdated verification systems slow your progress. Partner with RatifyID today to experience secure, compliant, and future-ready digital identity verification built for the next generation of digital trust.