- 13th May, 2025

- By Rob Wallace

Combating Fraud and Identity Theft With Digital Identity Verification

As more customers and businesses adopt digital technologies in their processes, fraud and identity theft risks are escalating alarmingly. Cybercriminals are getting smarter, using sophisticated methods to exploit vulnerable businesses and consumers.

Unfortunately, fraud and identity theft have a devastating impact on all parties, causing financial losses, legal repercussions, and reputational damage. As organisations, investing in robust identity fraud protection has never been more critical.

Digital identity verification offers a modern, secure solution that mitigates fraud risks and streamlines the customer experience. Identity verification solutions have come a long way since they were first introduced, with advanced technologies such as AI, biometrics, and automated identity checks now being the cornerstone of identity fraud protection.

Let’s examine how digital identity verification can benefit businesses that want to combat fraud and identity theft.

What is Fraud and Identity Theft?

Fraud is defined as a dishonest deception in an attempt to gain or benefit from a victim. Meanwhile, identity theft involves the unauthorised access, misuse, or manipulation of personal data to commit crimes.

Online systems are particularly vulnerable to fraud and identity misuse, such as credit card fraud, duplicate identities, scams, and stolen personal information. As the 2022 Optus data breach shows, even the largest companies can be victims of this cybercrime.

Unfortunately, the consequences of identity breaches go beyond just financial losses. Businesses face operational disruptions, legal liabilities, and diminished consumer trust. Meanwhile for consumers, it can mean significant financial distress and compromised personal security.

The Necessity for Identity Fraud Protection

With 1 in 4 Australians being a victim of identity theft and the issue costing individuals and businesses around $3.1 billion each year - prevention is critical.

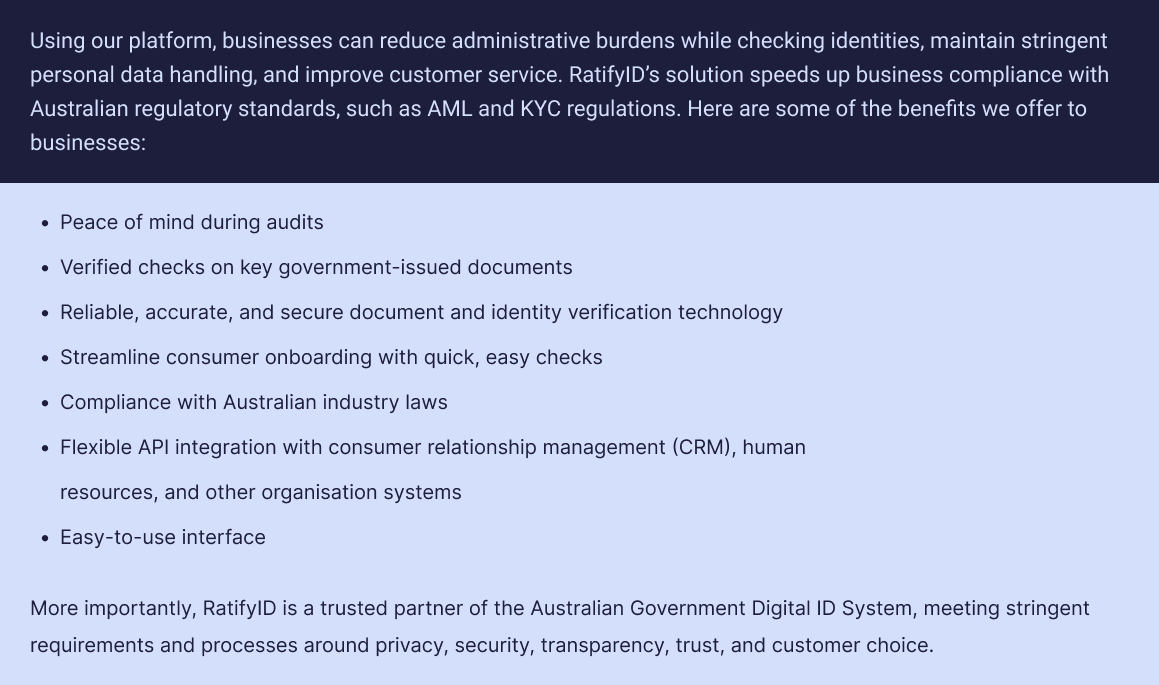

Australia has strict identity fraud protection laws, such as the Anti-Money Laundering and Counter-Terrorism Financing (AML/CTF), Privacy Act 1988, and Know Your Customer (KYC) requirements, which protect businesses and customers when conducting translations. Non-compliance with identity verification regulations can result in hefty fines and legal complications for many companies.

A secure identity verification process builds consumer confidence and shows a company’s commitment to protecting sensitive information. Strong fraud protection measures not only safeguard customers but also enhance a brand’s credibility.

However, one challenge remains: How can businesses protect customers’ identities and comply with stringent fraud protection laws while ensuring a seamless experience? For example, manually ensuring all customer information is available before supplying a service can be difficult, particularly when an impatient customer is waiting.

Enter digital identity verification, a seamless and easy way to get customers through the door.

Digital Identity Verification as a Cornerstone of Fraud Prevention

Digital identity verification uses advanced technologies such as Optical Character Recognition (OCR), AI-driven analytics, and biometric authentication to validate identities in real time.

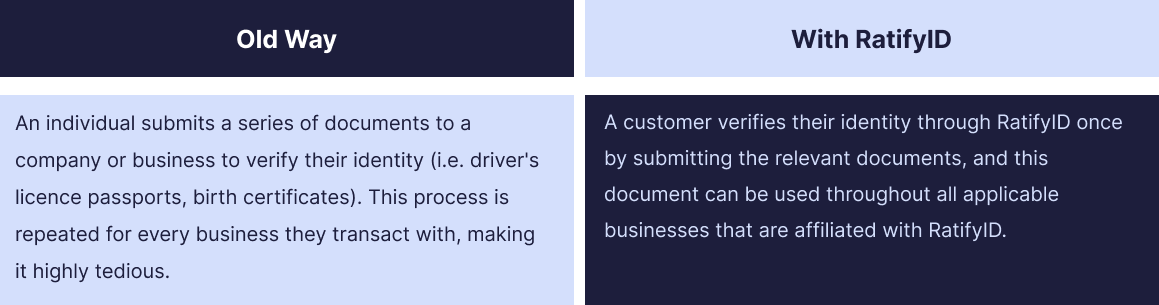

Verifying one’s identity online is simple. Compared to manual verification, digital verification offers superior speed, accuracy, and security. Traditional identity checks are often time-consuming and prone to human error, whereas automated systems are seamless and foolproof in verifying identities.

Businesses can verify online identities through an identity service provider. These providers use a secure online platform to verify identity documents against official government records, such as passports and driver's licences, in real time.

How RatifyID Delivers Identity Fraud Protection

RatifyID is an authorised identity service provider that provides seamless identity checks to streamline compliance and ensure the security and validity of consumer information. Here’s how the system works.

Implementing Digital Verification: Best Business Practices

If you’re considering adopting digital verification into your business, here are some key considerations on how to do it successfully.

Regular System Updates and Data Cleansing

Fraud tactics are constantly evolving, and outdated systems are prime targets for cybercriminals. Regular software updates ensure that sensitive business information is at lower risk of threats.

Businesses should also consider data cleansing - removing outdated, redundant, or incorrect database information. This helps reduce the risk of approval errors and ensures accurate identity verification.

Employee Training and Awareness

Even with the most advanced digital verification systems in place, human error can be a cause of security breaches. Businesses should prioritise ongoing employee training programs to educate staff on the latest fraud tactics, security best practices, and the proper use of verification tools.

Employees should also be trained to recognise phishing attempts, suspicious transactions, and other fraud schemes.

Choose the Right Digital Identity Provider

Fraud and identity theft remain a serious threat to businesses, but this can be mitigated by partnering with a trusted Digital ID provider like RatifyID. Our solutions help companies to verify customer identities easily while preventing identity theft, fraud, and duplicate customers.

Additionally, our solutions also offer single sign-on capabilities, eliminating the need for staff and customers to remember multiple usernames and passwords. This feature improves an organisation’s security by reducing the reliance on weak or reused passwords.

Contact our team to learn more about RatifyID’s identity document verification services.