- 6th June, 2025

- By Rob Wallace

Understanding Identity Verification: How Businesses Can Stay Compliant

In today’s digital age, identity verificationhas become a key business initiative. Whether onboarding customers and visitors, or hiring a new employee or contractor, verifying identities is crucial for businesses across all industries.

With increasing risks of identity theft and cyber fraud, Australian businesses are under more pressure from governments and consumers to take compliance seriously by safeguarding their operations and protecting customer data.

To navigate the complex laws and requirements related to identity verification, companies have leveraged the expertise of digital identity providers.

These providers, like RatifyID, help simplify the verification of identity while ensuring accuracy and security. This blog explores the importance of identity verification and why partnering with a DVS provider can benefit your company.

The Critical Role of Identity Verification in Business

What is Identity Verification?

Identity verification is simply the process of confirming an individual’s identity. It is typically done using official government-issued documents (e.g., driver's licence, birth certificate, and passport). In a business context, identity verification is done when onboarding a new customer, during the hiring process, and when signing up visitors to a physical location or online.

Verifying one’s identity ensures that businesses interact with legitimate customers and individuals, reducing risks associated with identity fraud, financial crimes, and reputational risks. To stay competitive, companies must verify identities quickly and securely to ensure customer satisfaction, making it a critical process.

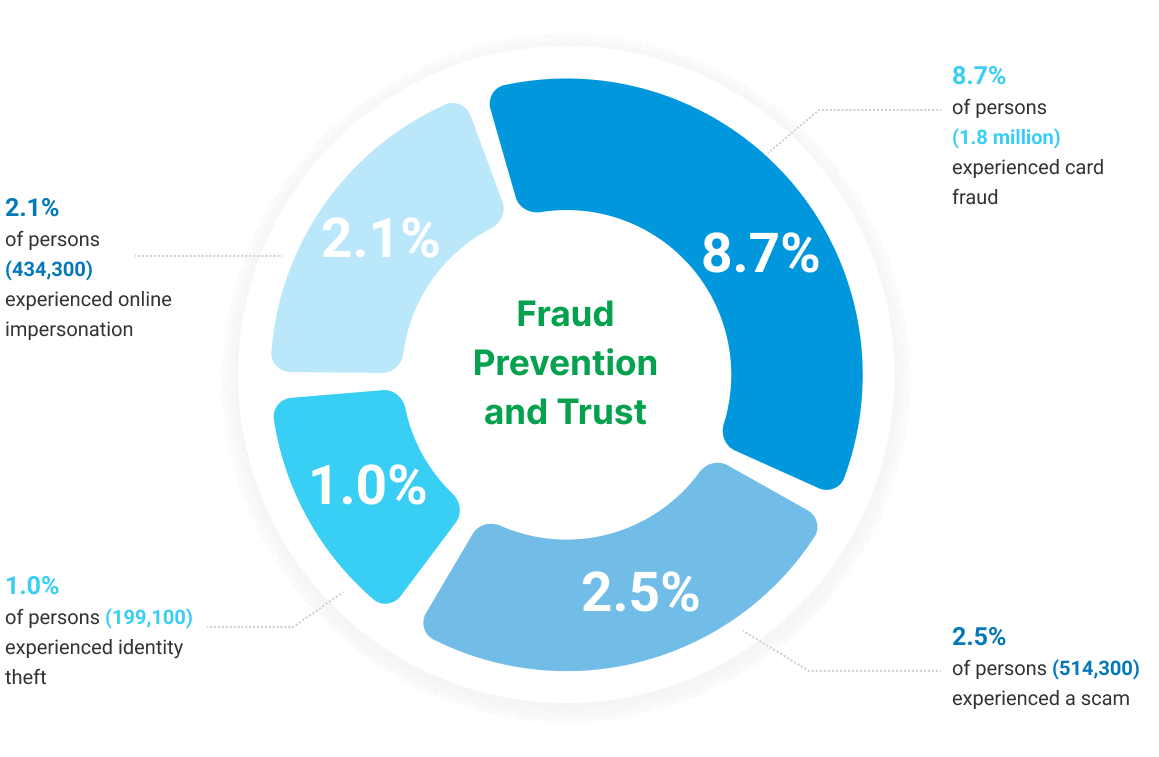

Fraud Prevention and Trust

Identity fraud is a growing concern, with cybercriminals exploiting weak verification processes to commit crimes such as identity theft and financial fraud. Here are some key statistics taken from the Australian Bureau of Statistics (ABS) associated with online fraud:

A robust identity verification system helps businesses prevent unauthorised access and fraudulent transactions. But beyond security, identity verification also fosters trust. Customers feel more confident engaging with companies that prioritise secure and compliant verification procedures, ultimately strengthening brand credibility and customer loyalty.

Understanding the Australian Regulatory Landscape

Identity Verification Laws: Overview of Key Regulations

Handling sensitive customer data comes with significant responsibilities, and businesses must adopt stringent security measures to protect identity information from breaches and any unauthorised access.

In Australia, complying with identity verification regulations isn’t just a best practice—it is a legal obligation. Laws such as the Anti-Money Laundering and Counter-Terrorism Financing (AML/CTF) Act and privacy regulations require businesses to verify identities securely and accurately.

Here’s a general overview of the key regulations:

The Importance of Digital Identity Verification Solutions

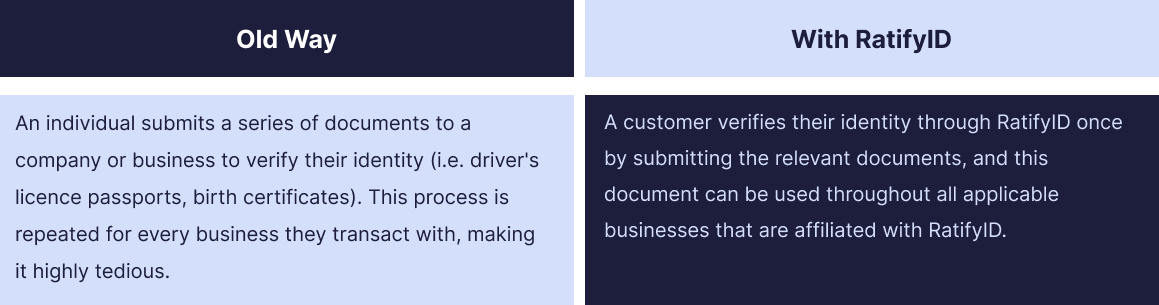

Digital identity verification solutions are a secure online system that allows businesses to verify identity documents against official government records, such as passports and driver's licences, in real time.

Instead of relying on manual checks, this service uses computer systems to send information via a secure communications pathway. Identities will be verified, and a yes/no response will indicate whether the information provided is identical to data recorded in the applicable government register.

Digital identity verification solutions are only accessible through approved digital identity providers like RatifyID. As an authorised provider, RatifyID streamlines compliance for many businesses with quick, seamless identity checks. Here’s how the system works.

Benefits of AI-Powered OCR Businesses and Industries

While there are many benefits to automating your identity verification, here are the 3 primary ones.

Enhanced Security

A well-implemented identity verification system protects businesses from the risk of identity fraud and being associated with financial crimes - which can impose unwanted penalties. With advanced yet simple verification methods, companies can significantly reduce fraudulent activities, unauthorised access, and data breaches, ensuring that their cybersecurity measures are robust.

Improved Customer Experience

Customer expectations have certainly evolved, and businesses are under more pressure to ensure quick, seamless, and secure verification processes. AI-powered OCR ensures that users can complete verification procedures quickly, leading to higher satisfaction rates and increased adoption of products and services.

Improved Customer Onboarding

In a competitive industry, having access to fast and seamless identity verification enhances the customer experience by eliminating unnecessary delays in the onboarding process. Businesses must now balance compliance with speed, as customers appreciate an efficient process that allows them to access services quickly.

Operational Efficiency

An automated, compliant identity verification system significantly speeds up administrative tasks, reduces operational bottlenecks, and frees up an organisation’s valuable resources. For growing businesses, investing in a reliable system that evolves as the company scales is essential.

Overcoming these challenges requires a strategic approach, and partnering with an expert digital identity verification service provider that can make the process much simpler. The right provider can reduce human error, ensure consistency, and minimise the costs associated with manual verification processes.

RatifyID is a trusted provider under the Australian Government Digital ID System that helps businesses verify customer identities easily. Our solutions allow companies to prevent identity theft, fraud, and duplicate customers, ensuring they remain compliant and secure.

Contact our team to learn more about our digital identity verification services.